ECONOMIC OUTLOOK & MARKET UPDATE

GDP & Manufacturing Strong to end 2021

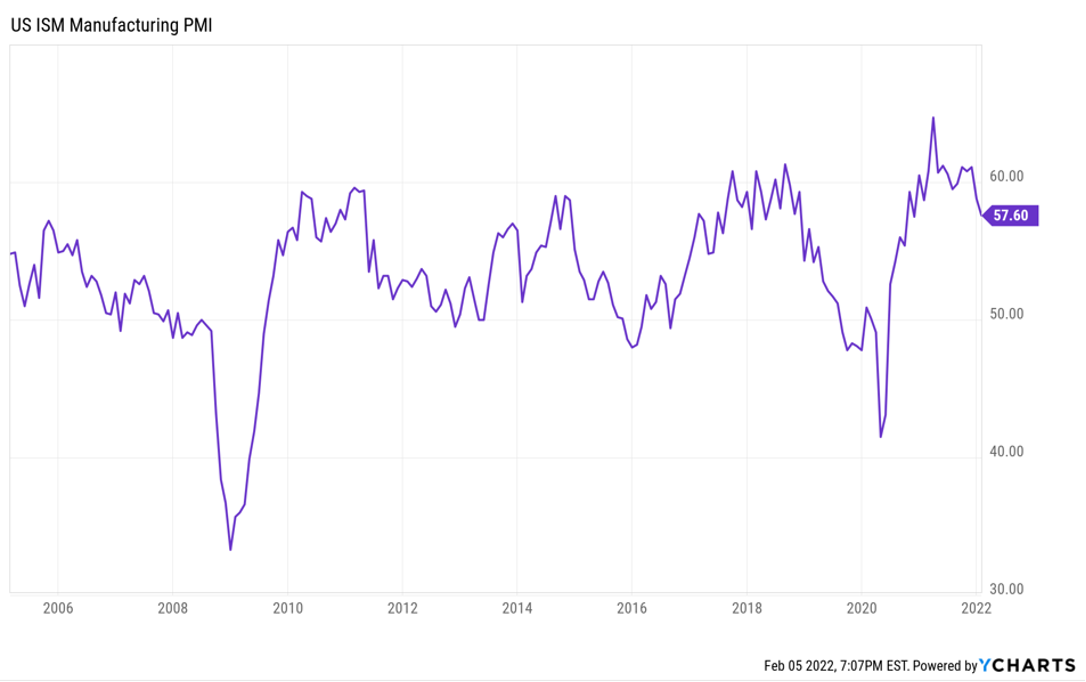

In the fourth quarter of 2021, GDP continued its strong growth coming in at 6.9% for the quarter, bringing the total GPD growth for 2021 to 5.7%, the strongest year for the U.S. economy in almost four decades. The increase in last year was a good indicator of the economy rebounding and adapting to the strains of the COVID-19 pandemic, and perseverance in adapting to the challenges posed by labor shortages and supply chain disruptions. However, recent surges in the Omicron variant as well as rising prices in raw materials across numerous manufacturing sectors has induced a slowdown to start the year, as was evidenced by a decline in the ISM Manufacturing Index in January 2022.

The takeaway is that there are still challenges ahead in 2022 amidst the recent surge in the Omicron variant and continued pandemic related risks, as well as continued constraints on production caused by global supply chain issues. Labor shortages amid already tight labor market conditions, as well as increasing prices of raw materials may further dampen production and GDP growth. However, the strong growth performance in 2021 was evidence of the ability of both the public and private sectors to quickly adapt. Consumer sentiment and spending continues to remain strong, giving an overall positive outlook on 2022 economic growth prospects.

Inflation Rising

December 2021 saw inflation rise to its highest rate since June of 1982, with the U.S. CPI for All Urban Consumers reaching just over 7%. Though GPD and economic growth has been promising, there remains a growing concern over the widespread rise in prices. Though this current environment makes many investors wary, it is important to note that historically, high inflationary periods have been commensurate with high growth in equity markets. In fact, the 12 month returns of the S&P 500 Total Return index have been positive in in 10 of the last 13 peaks in inflation going back to 1950, averaging 13.21%. See below for a chart of these returns:

| CPI INFLATION PEAK | ONE-YEAR FORWARD RETURN (S&P 500 TR) |

| February 1951 | 13.58% |

| May 1957 | -3.23% |

| November 1996 | 20.66% |

| January 1970 | 17.07% |

| December 1974 | 37.20% |

| March 1980 | 39.86% |

| March 1984 | 18.90% |

| November 1990 | 20.37% |

| March 2000 | -21.68% |

| September 2005 | 10.79% |

| July 2008 | -19.96% |

| September 2011 | 30.20% |

| July 2008 | 7.99% |

| December 2021 | ??? |

| AVERAGE | 13.21% |

Certainly, there are a number of factors in addition to just inflation to consider, and there is no guarantee that the market will be positive in 2022 simply due to high levels of inflation, but it is one of many indicators for strong overall outlook for 2022, despite some of the recent short-term volatility.

Interest Rate Increases

On Wednesday, January 5th, the Minutes from the Fed’s December 2021 meeting were released and indicated the Fed will begin rising rates in 2022, with increases coming as early as March. This will be in addition to the Fed’s plan to wind down their Quantitative Easing[1] plan also targeted for a March 2022 timeframe. This will be the first rate increase in more than three years. This move is in large part to combat the rising concerns of inflation and tight labor market conditions. In response to these signals by the Fed, the bond markets have reacted with a slight uptick across all treasury yields. Movements in the 10-year yield tend to be a sign of investor sentiment regarding the economy and future outlook. A rising yield indicates a falling demand for treasury bonds (price and yield move inversely for bonds), meaning investors prefer higher-risk, higher-reward investments elsewhere and have confidence in the future prospects of riskier investments. Therefore, the increase in the 10-year treasury yield may be indicative that the overall outlook for future economic and market growth is positive, as investors are not feeling the need to play it safe. However, its important to keep in mind that investor confidence is just one of many factors that may affect the 10-year treasury yield, and recent indications from the Fed of the coming interest rate hikes are also a factor impacting these recent increases in treasury yields.

[1] Quantitative Easing is a form of monetary policy used by the Federal Reserve and Central Banks, often to control interest rates. Quantitative Easing involves the purchase of securities (typically treasury bonds, though can be other longer-term assets) on the open market the Fed, thereby increasing the money supply in the economy. This provides more liquidity to banks, increasing their ability to lend to consumers (more supply) and thereby decreasing market interest rates and encouraging investment in the economy.

MARKET UPDATE

Equity Market Correction

The stock market has had steady decline to start 2022, and our short-term and intermediate-term market signals, Alpha & Omega, both turned negative last month. All major U.S. indices fell below their 200-day moving averages in January, which is a further negative sign for the equities markets. We have seen some rebound in the short-term, though it appears to be the result of the market being oversold (evidenced by high trading volume the last couple weeks) during this volatile period. The volatility over the past couple weeks has made it increasingly uncertain whether this was a short-term false signal, or if we will experience a further downturn in equities. The stock market remains near its all-time high, and is viewed by many to be the most overvalued in history by traditional metrics such as Price-to-Earnings (P/E) ratios and the Buffet Indicator (equity market cap divided by Gross Domestic Product), and the Fed recognizing last April that “financial assets, broadly are at elevated valuation levels.” However, the overall positive economic outlook, increasing interest rate environment, and risking inflation all point to continued growth in equity markets over 2022. We do expect to experience significantly more volatility this year compared to recent years, and thus will look to our Alpha & Omega market signals to help navigate our Dynamic Allocations during this turbulent environment and help protect against substantial downturn movements.

Bond Market Downturn

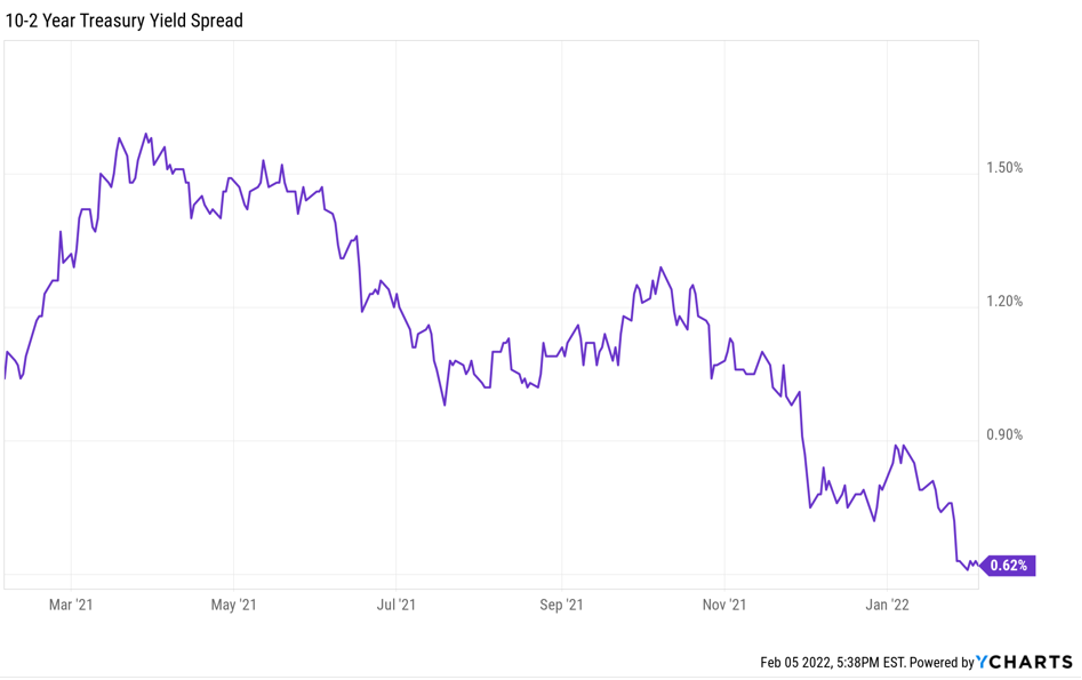

The bond market has begun 2022 with a downturn as a result of the Fed’s indication it will begin interest rate hikes in 2022. The high-yield and corporate bond sectors will be less attractive as the Fed Fund’s rate begins to rise and the “risk free rate”[2] with Treasury Yields climbs. The 10-year Treasury yield has risen to 1.82% as of February 3, 2021. However, the 10-year vs. 3-month yield spread has remained little changed, indicating that the short-term treasury yields are already beginning to inch higher. The biggest change has been in the 10-year vs. 2-year treasury yield spread, which has dropped substantially this month down to 0.62%. This flattening of the yield curve is likely primarily a result of the impending interest rate increases by the Fed, though drops in bond prices and the corresponding inversely correlated increase in yields is representative of a broad decrease in bond demand, which again may be representative of investors having confidence in the positive outlook of the market as the seek higher-risk, higher-return investments instead of bonds and Treasuries.

[2] “Risk-free rate” represents the interest an investor would expect from an absolutely risk-free investment. Though there can never be a truly risk-free rate or risk-free investment, the standard proxy for measuring the risk-free rate is the 3-month U.S. Treasury bill. This is generally accepted as the safest investment an investor can make as it is backed by the full faith and credit of the U.S. government and the market considers there to be virtually no likelihood of the U.S. Government defaulting on its obligations.

SMARTER WAY TAKEAWAYS

Overall Outlook for 2022 is positive

Despite the choppy start to 2022, our overall outlook for the year remains positive from both an economic and market perspective. We anticipate 2022 to be more volatile compared to recent years, however the growth targets for the year remain above the historical average compound annual growth rate of the market. Though past performance is never indicative of future results, a look at historical periods of high inflation indicates that the market has typically seen robust growth. The strong performance at the tail end of 2021 in U.S. GDP and the ISM Manufacturing Index, as well as recent increases in the 10-year Treasury yield are indicative of a positive economic outlook.

Alpha & Omega Status Change

Alpha and Omega turned negative on January 24th, 2022. Though the overall outlook for 2022 is positive, we continue to monitor the overvalued nature of the stock market and remain cognizant of the possibility for a substantial downturn in the equities markets with the recent onset of increased volatility. As of now, both market signals remain negative. As a result, we have reduced our equity exposure in our Dynamic Allocations by reducing the equity model weightings by 50% and reallocating to our Diversified Fixed Income model. We anticipate a higher likelihood of more signal changes this year than we have seen in recent years due to this volatile environment.

Changes to our Diversified Fixed Income Model

With the recent indicators of raising interest rates in 2022, fixed rate corporate and high-yield bonds will be negatively affected in their prices. This has been reflected notably in the Bloomberg Barclays U.S. High Yield Corporate Bond Index, which dropped below its 100-day moving average in January 2022. As a result, we have shifted our Diversified Fixed Income Model’s exposure out of High Yield, Corporate, and Broad Bond Market sectors and into to Government Bond sectors. The recent movement of the yield curves has shown 10-year and 2-year yield curves rising faster than the short-term 3-month yields. We are positioning our model in intermediate-term bond ETFs, though will continue to monitor the movement of yield curves as rate increases and Fed policy moves unfold.

OUR MARKET SIGNALS

Alpha/Omega (Equity Market Indicators)

Alpha and Omega are a pair of equity market trend indicator algorithms managed by our Team. Alpha is a short-term indicator that tends to be more active, while Omega indicates longer-term trends and is less active. We use these trend indicators to provide input for our Large, Mid and Small Cap equity models; as well as our Dynamic and 401(k) Allocations.

Both Alpha and Omega are negative, resulting in only 50% of the maximum equity exposure in our Dynamic Growth Allocations.

Gamma (Equity Market Growth vs. Value Indicator) NEW INDICATOR

Gamma is our third equity market trend indicator algorithm managed by our Team at A Smarter Way to Invest that identifies and measures key market metrics, which indicates whether Growth sector versus Value sector equities are poised to outperform the other in the future. We use this trend indicator to provide input for our Large, Mid and Small Cap models.

Gamma currently indicates Value is more favorable, resulting in a heavier weighting in Value Equities in our Large, Mid and Small Cap models.